Benefits of a Luxemburgish

life insurance

Luxembourg life insurance is a tool of choice for the management of your wealth. You benefit of a large flexibility in the selection of your investments, of the tax neutrality and a first rank protection guaranteed by the triangle of security.

Luxembourg life insurance is a personalized solution that can support you to plan your succession and to preserve, structure, and transmit your wealth.

Wherever you are in Europe, WEALINS allows you to access innovative solutions and premium services compliant with the legal and tax framework of your country of residence. In application of the 3rd European Life Directive that established “the Freedom to Provide Services”, the life insurance or capitalization contract is governed by the law of your country of residence.

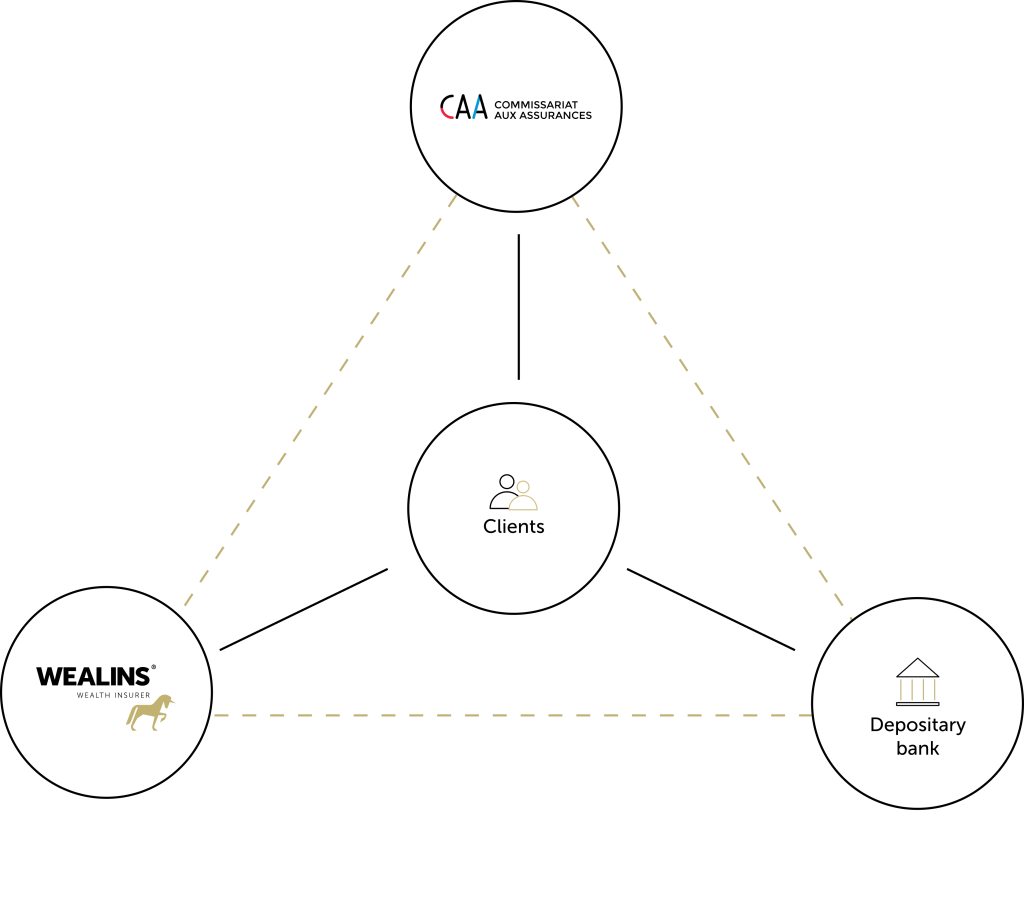

The triangle of security, specificity of Luxembourg life insurance

Thanks to the unique “triangle of security” mechanism, the Luxembourg legislation provides one of the strongest protection framework in Europe. This triangle of security is materialized by a tripartite agreement between the insurance company, the Commissariat aux Assurances (CAA), and the depositary bank.

It offers high guarantees to the policyholder together with a triple protection:

- A separation of your assets, those of the shareholders and those of the creditors of the insurance company

- A quarterly control of the balance between the liability of the insurance company towards its clients and the technical provisions representing these liability

- A “super-privilege” that allows you to become a first ranking creditor on all regulated assets. Should the insured default, your claim has priority over the distribution pool of assets underlying each type of claim concerned

Tax neutrality of our solutions

Luxembourg life insurance is based on the tax neutrality principle. As a non-resident policyholder or beneficiary of the insurance contract, the applicable taxation is the one of your country of residence. You will therefore not be taxed in Luxembourg.

The taxation of life insurance solutions is often more favorable than other types of investment. It only applies at the time at the payment of the guarantee or at the payment or surrender, on the capital gains and interest generated. The income from the policy remains therefore invested on the long term, which means that all profits can be reinvested.

With the portability of the contract, your life insurance will accompany you everywhere

WEALINS designs life insurance as a customised solution that takes into account your evolving situation today and tomorrow.

Thanks to the “portability” of our solutions, we can support you everywhere. When you move for private or professional reasons, we adapt the contract to the legal and fiscal framework of your new country of residence.

Our solutions offer a wide range of assets

WEALINS’ solutions give you access to a wider range of financial assets compared to the ones available in your country of residence.

To learn more, discover our solutions.